Accounts Payable Automation

The way to ensure a small company’s financial well-being is by making sure that supplier invoices are paid accurately and on time. However, in B2B transactions, manual handling of invoices can be problematic due to potential errors and the time-consuming nature of processing invoices. These issues make it challenging for SMEs to keep track of bills, organize supplier information, and optimize cash flow. By using integrations with accounting systems, businesses can automate AP processes, which reduces manual work, minimizes errors, and streamlines payment cycles. Here’s how these powerful integrations can be used to automate accounts payable.

Apideck ‘s unified Accounting API helps B2B software and fintech companies to integrate directly with their customers’ ERP & Accounting systems. Apideck’s platform can generate notifications (webhooks) for a critical webhook events such as new bills or supplier creation.

Understanding Accounts Payable

Accounts payable is the management of a business’s outgoing payments to vendors or suppliers for goods or services received. Traditionally, invoice data entry, approval workflows, and payment scheduling have been manual processes—time-consuming and prone to mistakes. Accounting integrations enable AP automation by providing real-time data sharing and streamlined processing.

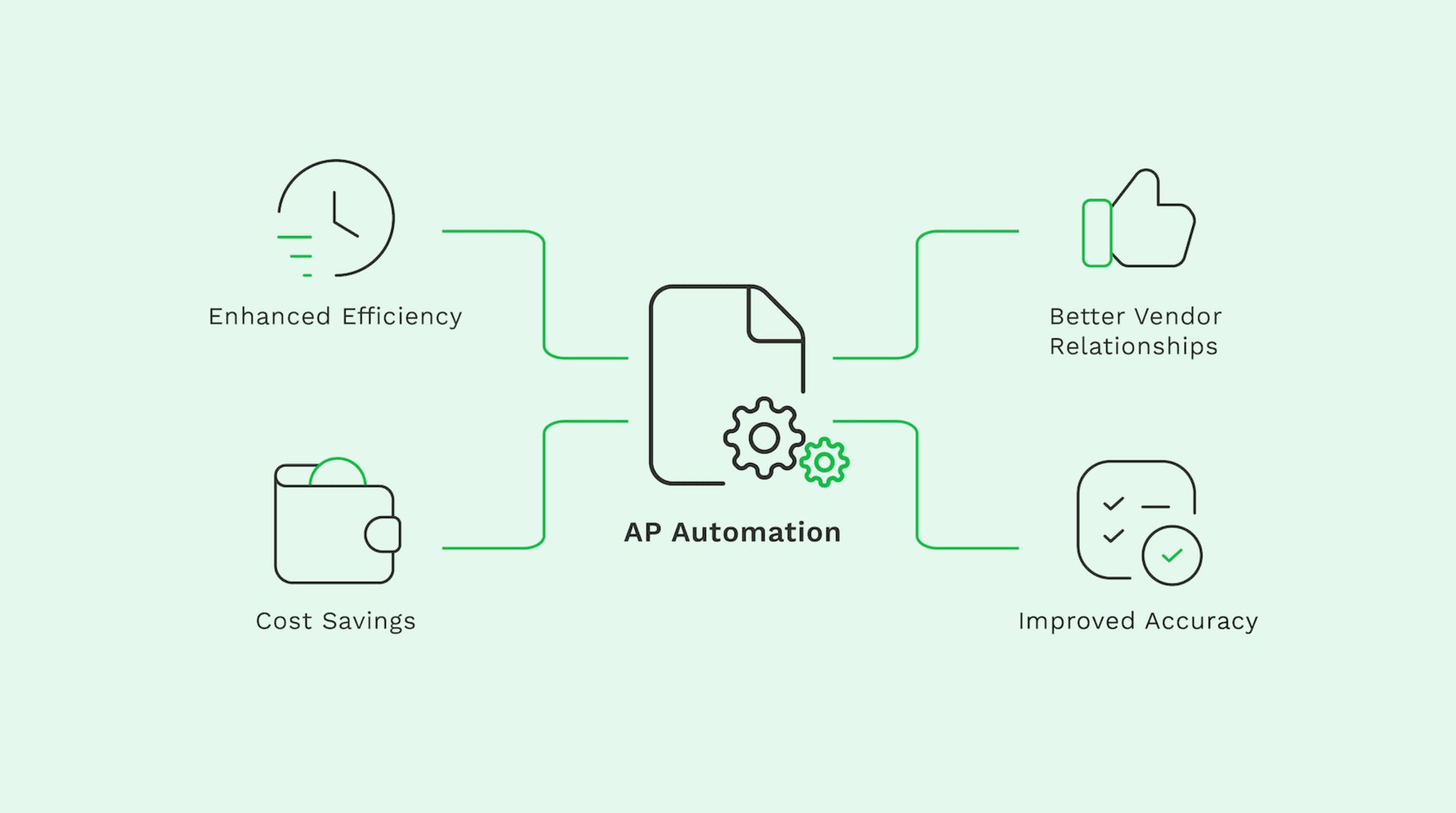

Significant Advantages of AP Automation

-

Improved Efficiency and Productivity Automation eliminates manual data entry and repetitive tasks, enabling finance teams to focus on higher-level activities such as cash flow forecasting and vendor relationship management.

-

Enhanced Accuracy and Reduced Errors Automated data entry and invoice matching minimize human error. This boosts accuracy in payment processing and helps maintain a trustworthy vendor ledger.

-

Optimized Cash Flow Management By automating payment schedules and approvals, businesses can avoid late fees, capture early payment discounts, and maintain healthy working capital.

-

Real-time Financial Insights With integration to accounting systems, you gain up-to-date views of payment obligations and expenditures. These insights can inform budgeting, cash management, and strategic financial planning.

-

Better Vendor Relationships Timely and accurate payments lead to better relationships with suppliers, often resulting in more favorable terms and pricing.

How Accounting Integrations Enable AP Automation

-

Standardized Integrations By integrating your platform with common accounting software, bills and purchase orders can be created, tracked, and approved automatically. This reduces manual entry, speeds up processing, and lowers the risk of errors.

-

Automated Invoice Matching Integrated systems can match invoices with purchase orders and receipts in real time. This ensures accuracy, prevents duplicate payments, and simplifies reconciliations.

-

Streamlined Approval Workflows Accounting integrations can trigger automated approval workflows. Authorized personnel are notified to approve or reject payments, ensuring a clear audit trail.

-

Real-time Data Synchronization Ongoing, automated data sync keeps financial records up to date across multiple systems. A single source of truth improves your reporting and analysis capabilities.

-

Advanced Analytics and Reporting With integrated AP data, businesses can leverage detailed reporting to identify spending trends, monitor supplier performance, and project future liabilities.

Bill Pay

One of the most critical components of AP automation is Bill Pay—the process of scheduling and executing payments to vendors. By automating Bill Pay, businesses can:

-

Schedule Payments in Advance Ensure invoices are paid before their due date, reducing the risk of late fees.

-

Choose Preferred Payment Methods Select how to pay vendors (e.g., ACH, checks, credit cards) based on cost, vendor preferences, and convenience.

-

Improve Cash Flow Forecasting Gain visibility into upcoming payment obligations to better predict and manage cash needs.

-

Reduce Administrative Overhead Eliminate manual tasks related to writing checks, coordinating approvals, and monitoring payment statuses.

A Future Proof Integration Partner

Depending on your customer base and the accounting system they use, Apideck’s unified API allows you to connect to dozens of accounting systems (Sage, Xero, QuickBooks, NetSuite, Sage, Exact Online, …) using a single integration. You can find a full overview on our docs. This considerably reduces the amount of development time required to integrate with the different applications your customers may be using.

Additionally, Apideck handles the full authentication flow, so your customers can seamlessly connect their accounting system of choice. Apideck Vault supports OAuth, securely stores API keys, and handles token management so your engineering team can focus on building your core product.

Automating accounts payable through accounting integrations is essential to modernizing and optimizing your customers’ financial operations. By embracing AP automation technologies, businesses can achieve higher efficiency, better accuracy, and tighter financial control—driving growth and success. As the business landscape evolves, companies that harness the power of automation will remain ahead of the curve.

By using AP automation integrations, organizations can not only streamline their financial processes but also build a more dynamic and proactive finance function that aligns with long-term strategic goals. The future of accounts payable is automated via seamless integration.

In addition to streamlining your AP workflows, Apideck also enables seamless Accounts Receivable (AR) automation. By integrating your platform with popular ERP and accounting systems through Apideck’s unified API.

By offering both AP and AR automation capabilities, Apideck delivers a comprehensive approach to building native end-to-end accounting automation integrations.

Ready to get started?

Scale your integration strategy and deliver the integrations your customers need in record time.

Ready to get started?

Not sure how Apideck can help you scale your business? We're here to help with any questions.